The Florida Legislature’s special session ended on Wednesday, when the Florida House passed three bills related to hurricane disaster relief, toll road rebates, and property insurance reform. The bills will now head to Governor DeSantis’s desk for his signature.

While the special session was originally scheduled for the full week, it ended in just three days. The Florida House and Senate both have Republican supermajorities, which means they can move bills very quickly through the committee process, and dispense with traditional rules like waiting a day between the required three readings of bills on the floor.

And when it came to amendments — the give-and-take of the legislative process which normally transforms a bill from its raw draft form into a more polished version — Democrats introduced several, but they were all quickly rejected.

However, that does not mean there was unanimity within the Republican caucus. Although the two bills relating to toll roads and disaster relief were relatively noncontroversial, the property insurance bill stirred up a number of questions, even from Republican members of the Senate.

And the final vote in the Senate — 27 Yeas and 13 Nays — included two Republicans who voted against it, Senator Ileana Garcia and Senator Erin Grall, with one Democrat crossing the aisle to vote for it, Senator Linda Stewart.

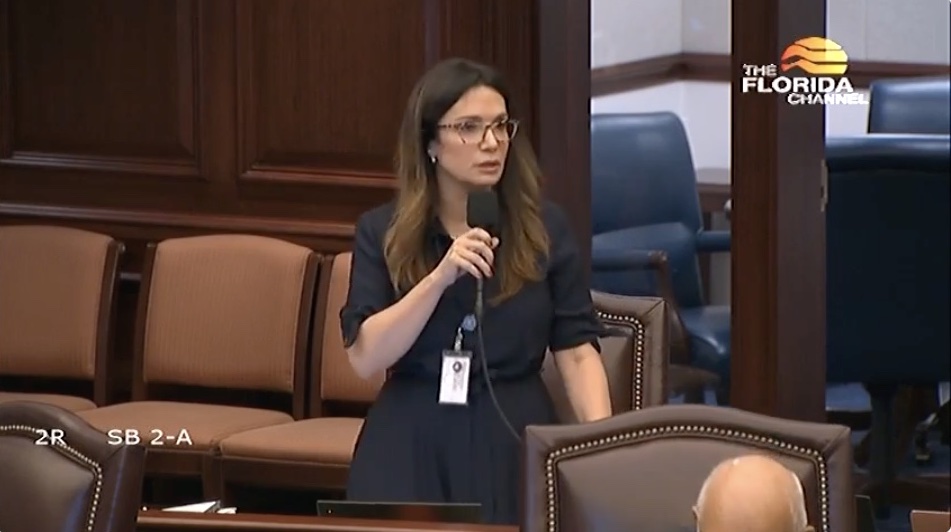

As the bill was being debated on the floor of the Senate, Sen. Garcia said she was struggling with the question of “Where are the protections? Who protects the policyholders from the companies that denied them?” She went on to ask how cutting litigation cost benefits the policyholder and into the future.

Senator Ileana Garcia (R-Miami), asks questions about SB 2A Property Insurance on December 13, 2022.

Sen. Garcia also mentioned force-placed insurance companies. Force-placed insurance is a blanket insurance policy that a mortgage company “forces” onto a mortgage holder when their regular property insurance lapses. The cost of the policy is usually much higher and can sometimes cause a borrower’s monthly mortgage bill to double. Senator Garcia brought up these force-placed insurers and asked, “Will they fall under the same scrutiny and regulations that we are implementing to keep companies from going insolvent?”

But in the end, the same 105-page bill which was filed on Friday night was the same bill which passed on Wednesday.

What is the consensus about this legislation?

There’s no doubt: this bill is a major reform for the Florida property insurance marketplace. And it’s going to take a while to fully understand what just happened in the Florida Legislature. While we’re still analyzing it, a growing consensus seems to be emerging that this bill is mostly a pro-industry bailout of the property insurance industry, paid for by taxpayers. Unfortunately, even though taxpayers are footing the bill, there is not much in the way of increased transparency of the property insurance industry.

No rate decreases anytime soon

Everyone agrees that we’re not going to see any rate decreases for a while — maybe even for a couple of years.

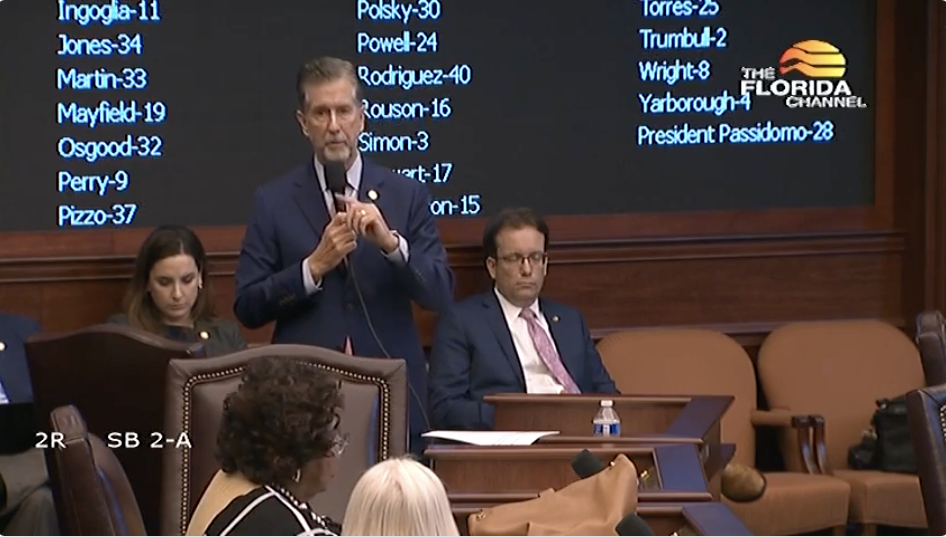

Senator Jim Boyd, sponsor of the bill praised the lawsuit reforms in his bill and said, “At the end of the day, I truly believe these reforms will take good effect and will help not only Citizens’ rates to stabilize, but also allow the private market to stabilize their rates, and ultimately bring more interest back into Florida from carriers who want to do business [here]…. When they come, and they will, I believe, it’s going to drive rates and opportunity down for everyone.”

Senator Jim Boyd (R-Bradenton), answers questions about his property insurance bill on the floor of the Senate, December 13, 2022.

Citizens Property Insurance Customers Facing Increases

If you have Citizens Property Insurance, you will be facing double digit increases in your property insurance rates. This reform was transparent in its goal of “depopulating” Citizens, the Florida insurance provider of last resort, and moving those customers into the private market.

Reforms that will go into effect for Citizens policyholders include:

- a guaranteed 12% rate increase across the board.

- new flood insurance requirements for Citizens policyholders who live in FEMA-designated flood zones

- And requirements that are designed to move policyholders to the private marketplace (if you’re offered private insurance that’s up to 20% above what you’re paying for Citizens, you’re automatically removed from Citizens and must take that other policy)

- Citizens customers now face a “burden of proving” any water damage claims are not related to flood damage.