If you’re a homeowner in Hurricane Ian’s anticipated path, you may want to think about how to get ready for insurance claims as you get ready for the storm.

According to the National Hurricane Center’s Monday update on Sept. 26, Hurricane Ian is moving toward the northwest near 13 mph with sustained winds near 80 mph. Unpredictable winds, storm surge, and massive rainfall in some areas could mean Hurricane Ian will leave a trail of destruction in its wake that could take months to clean up.

On the forecast track, the center of Ian is expected to approach the west coast of Florida on Wednesday into Thursday, when it is expected to have strengthened and become a major hurricane.

The Atlantic hurricane season started June 1 and will end Nov. 30. Last year, weather and climate disasters in the U.S. cost $145 billion, according to government data.

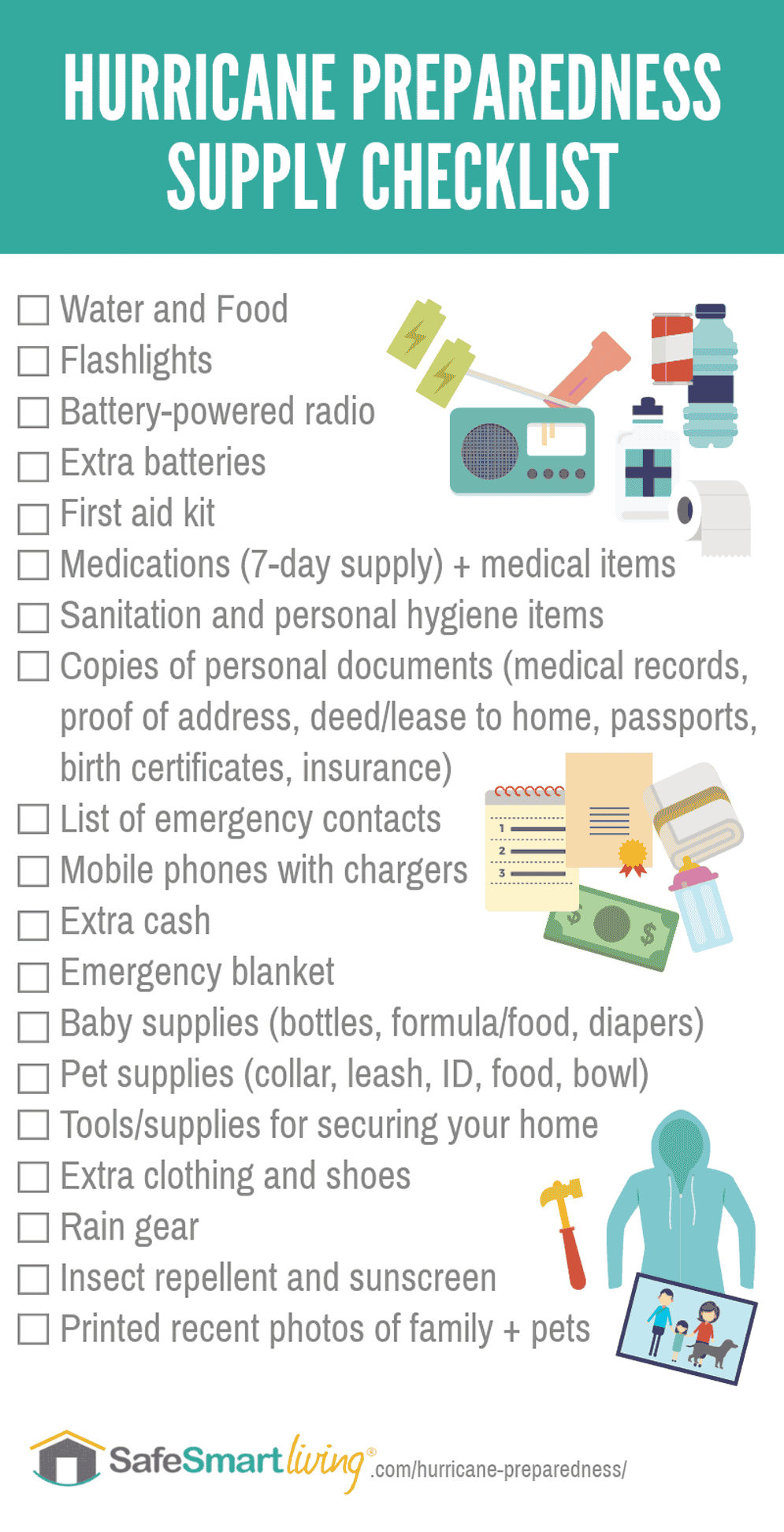

Make sure you’re preparing for the hurricane by:

- Reviewing your evacuation plan and, if you have a pet, your pet’s evacuation plan

- Make sure your hurricane kit includes a minimum seven-day supply of non-perishable food and drinking water (one gallon per person, per day) for all family members and pets, as well as a one-week supply of medications for everyone in your household.

- Write down the name and phone number of your insurer and insurance professional and keep this information either in your wallet or purse

- Purchase emergency supplies, such as batteries and flashlights

- Fully charge your cell phones so you can receive weather alerts

- Prepare your yard by removing all outdoor furniture, lawn items, planters and other materials that could become airborne due to high winds

- Fill your car’s gasoline tank

Amid the emotional upheaval caused by natural disasters, anticipating an insurance claim in advance can mean one less stressor if a worst-case scenario unfolds.

In addition to all of these common sense hurricane-prep tips, there are a few things you can do to prepare for an insurance claim:

1. Do a home inventory

One of the easiest ways to document the condition of your house and belongings is to take pictures — lots of them. You should get shots of both inside and outside from various angles and be as thorough as you can.

Use technology to make your home inventory easier

A simple pencil and paper will suffice, but technology can make creating a home inventory much easier.

- Take pictures – Create a photo record of your belongings. Capture important individual items as well as entire rooms, closets or drawers. Label your photos with what’s pictured, where you bought it, the make or model—whatever information might be important to replacing and/or getting reimbursed for the item. Use your smartphone or digital camera—some give you the capability to put in the description of the item when saving the photo.

- Tape it – Walk through your house or apartment videotaping and describing the contents. For example, you might describe the contents of a kitchen cabinet: “Poppies on Blue by Lenox, service for 12 that includes a dinner plate, salad plate, bowl, cup and saucer. Purchased in 2015.”

- Use an app – There are many mobile app options that can help you create and store a room-by-room record of your belongings.

2. Review and understand your coverage

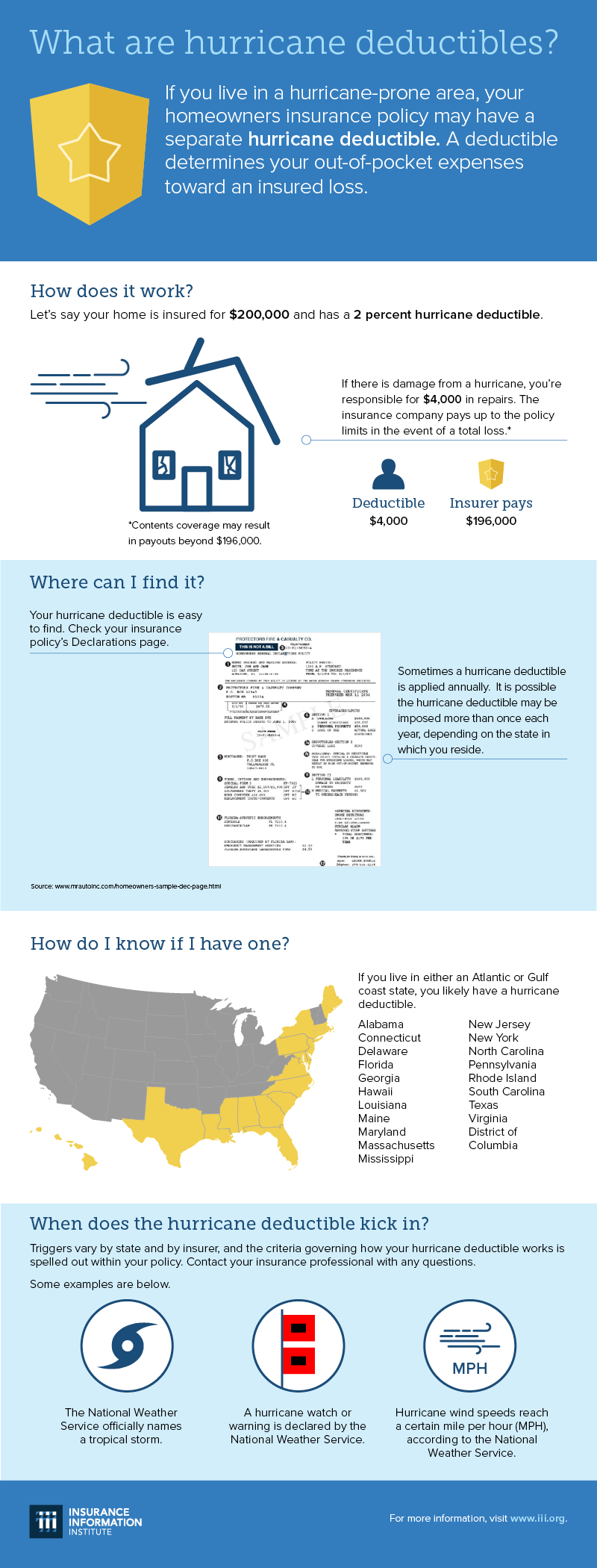

The declarations page of your insurance policy is a summary that offers details on how much coverage you have, your deductibles and how a claim will be paid, according to the III. If you have questions, you should contact your agent.

More: Understanding your insurance deductibles (from III)

Most homeowners insurance comes with a hurricane deductible. It typically ranges from about 1% to 5%, depending on the specifics of your insurance contract.

Note that the percentage is based on your insured value, not the damage caused. So if your home is insured for $200,000 and you have a 2% hurricane deductible, you’ll pay $4,000 whether the damage is $5,000 or $50,000.

Be aware that policies generally exclude damage caused from flooding, which means you’d need to have separate coverage in place for this storm (flood insurance takes 30 days to go into effect).

When a homeowner faces storm-related damage that is uncovered but in a federally declared disaster zone, there might be government programs that can provide financial assistance through grants or loans. However, that help is not guaranteed, and it likely wouldn’t get you quickly back on your feet.

For instance, after 2017′s Hurricane Harvey, which dumped as much as 60 inches of rain in some spots in Texas, the average grant from the Federal Emergency Management Agency for individuals was $7,000, while the average claim through the National Flood Insurance Program was more than $100,000.

Incidentally, you can check your flood risk at realtor.com, which has started including that information alongside other details about properties.

3. After the storm

If you end up with damage from Ian, you should reach out to your agent.

You should take photos of the damage your home sustained and then take reasonable steps to protect your property from further damage.

Also avoid throwing out damaged items until after an insurance adjuster has visited your home. Hang on to any pertinent receipts, as well.

In most instances, an adjuster will inspect the damage to your home and offer you a certain sum of money for repairs, based on the terms and limits of your homeowners policy. The first check you get from your insurance company is often an advance against the total settlement amount, not the final payment.

More About the 2022 Changes in Property Insurance Law

The Florida Legislature held a Special Legislative Session in May 2022 specifically to address property insurance. The Legislature passed two bills Governor DeSantis signed on May 26, 2022. Here are the key changes these bills made.