Updates

How you can prepare for insurance claims after Hurricane Ian

One of the most important things you can do to prepare for insurance claims is to have an inventory of your home.

Can installing rooftop solar panels get your home insurance canceled?

Many rooftop solar owners may be surprised to learn that their new solar systems may affect their home insurance bill.

Floridians For Honest Lending Urges Legislature to Take Consumer-Focused Approach to Insurance Reform

The consumer lending watchdog group Floridians For Honest Lending and the insurance reform group Federal Association For Insurance Reform (FAIR) released an educational video about short-term and long-term solutions to fix Florida’s broken property insurance market. The video is part of a series about the increased risk of foreclosures if the Legislature fails to provide stability to Florida’s property insurance marketplace.

Homeowner Facing Foreclosure While Waiting for Homeowner Assistance Funds from State of Florida

A homeowner in the Orlando area is behind on his mortgage, like thousands of Floridians across the state, because of the pandemic. After applying for mortgage assistance relief, he now faces foreclosure while he waits for an answer to his application.

The Miami-Dade Bar and Floridians for Honest Lending hold seminar for those at risk of losing their homes

On April 7, the Miami-Dade Bar Association’s Foreclosure Committee hosted a virtual panel so that homeowners can learn how to protect themselves. At this panel, industry experts talked about homeowners’ rights, how to fight dirty tricks from lenders, and what they can do to avoid being scammed if they are requesting a loan modification.

Homeowner Bill of Rights Introduced

As reported in Florida Politics, Sen. Ileana Garcia and Rep. Juan Fernandez-Barquin held a news conference in the Capitol on Monday to unveil legislation designed to protect Floridians from predatory foreclosure practices.

Nearly 300,000 Florida Households Behind on Mortgage Payments

Census Data Shows Nearly 1 Million Florida Households With No or Slight Confidence in their Ability To Pay Next Month’s Mortgage

Recent data from the US Census Bureau’s Household Pulse Survey shows that there are more than 6.3 million households in the United States that are not current on their mortgage payments, and nearly 300,000 of those are in the state of Florida.

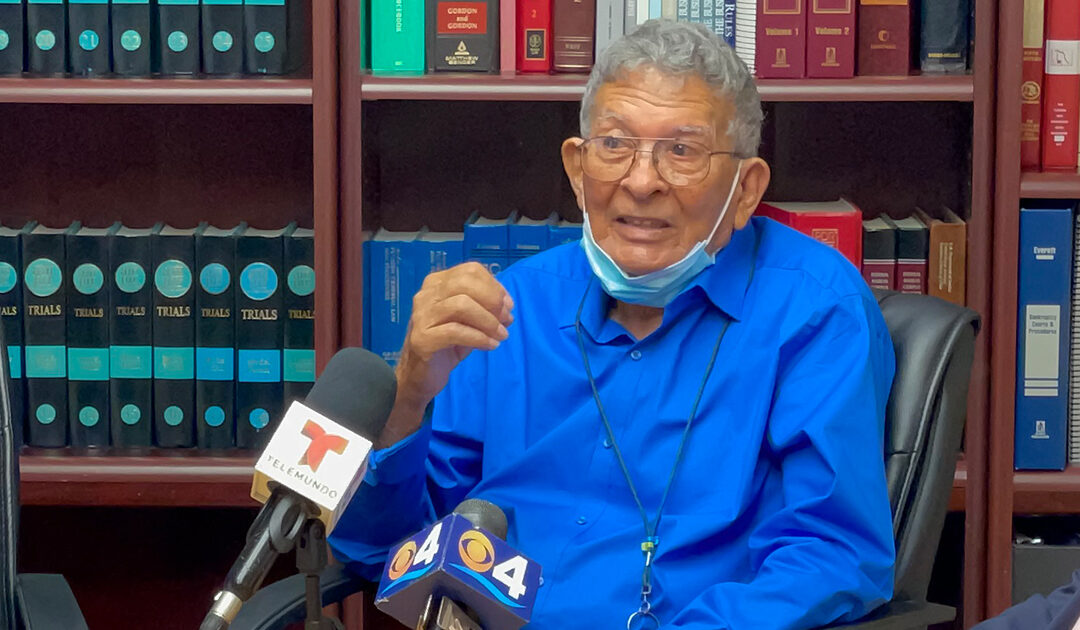

A 91-Year-Old Risks Losing His Home Over $20

At 91, José Torrado faces the possibility of losing his home over a $20 discrepancy. His bank, Bank of New York Mellon, attempted to foreclose on his home, claiming he did not have proper homeowners insurance, even after Mr. Torrado provide proof of insurance, sending him confusing claims that Mr. Torrado did not understand.

‘We need to move on’: Judge rejects delaying Miami eviction of ex-Cuban prisoner | Miami Herald

A judge denied a motion Thursday to delay the ouster of former Cuban political prisoner Ana Rodriguez from her Miami home after her lawyer sought an emergency hearing to argue the recently extended eviction moratorium should apply to her case.

As moratoriums lift, will America face a wave of foreclosures and evictions? | The Economist

Almost 8% of mortgage-holders in Miami are delinquent, among the highest share in the nation. Meanwhile, people renting housing face the end of a federal moratorium on evictions at the end of the month. A moratorium on mortgage foreclosures ends at the same time, raising fears of a spike in houses lost amid a house-price boom.